Tutorial: Mortgages in Switzerland (Part 1)

In this tutorial, we examine the requirements for taking out a mortgage in Switzerland, the associated risks, the possible decisions, and the flexibility available in structuring your loan.

This website offers a free tool to calculate various mortgage scenarios. You can also check whether the required conditions are met. Mortgage parameters and results can be shared via a link—for example, with advisors, family, or friends.

▶️ Prefer to watch? Here's a video version of this tutorial:

We begin by summarizing the current situation. The reasons behind the system's structure will be explained in later parts. This tutorial focuses on how to calculate a mortgage.

Summary

Mortgages in Switzerland have some unique characteristics and differ significantly from those in neighboring countries (Germany, France, Italy). Compared to other countries, Swiss mortgages generally have:

- very low interest rates

- very long total durations

- relatively strict lending criteria

- relatively flexible amortization rules

- very high property prices

This combination means that mortgages tend to remain active for a long time, and a large portion of household wealth is tied up in real estate.

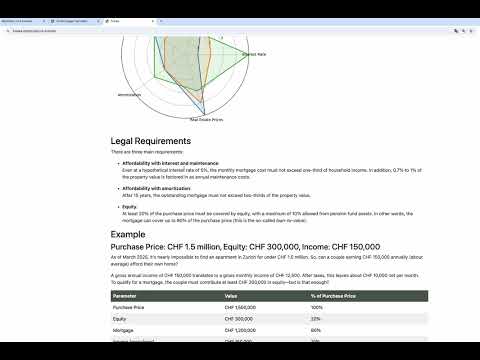

The graph below summarizes these characteristics – compared to the USA and Turkey, examples of high inflation countries.

Legal Requirements

There are three main requirements:

-

Affordability with interest and maintenance:

Even at a hypothetical interest rate of 5%, the monthly mortgage cost must not exceed one-third of household income. In addition, 0.7% to 1% of the property value is factored in as annual maintenance costs. -

Affordability with amortization:

After 15 years, the outstanding mortgage must not exceed two-thirds of the property value. -

Equity:

At least 20% of the purchase price must be covered by equity, with a maximum of 10% allowed from pension fund assets. In other words, the mortgage can cover up to 80% of the purchase price (this is the so-called loan-to-value).

Example

Purchase Price: CHF 1.5 million, Equity: CHF 300,000, Income: CHF 150,000

As of March 2025, it's nearly impossible to find an apartment in Zurich for under CHF 1.5 million. So, can a couple earning CHF 150,000 annually (about average) afford their own home?

A gross annual income of CHF 150,000 translates to a gross monthly income of CHF 12,500. After taxes, this leaves about CHF 10,000 net per month.

To qualify for a mortgage, the couple must contribute at least CHF 300,000 in equity—but is that enough?

| Parameter | Value | % of Purchase Price |

|---|---|---|

| Purchase Price | CHF 1,500,000 | 100% |

| Equity | CHF 300,000 | 20% |

| Mortgage | CHF 1,200,000 | 80% |

| Income (gross/year) | CHF 150,000 | 10% |

| Income (net/month) | ~CHF 10,000 |

Calculation with CHF 300,000 Equity

Answering the main question upfront: Definitely not!

A quick glance at the figures is enough to see the gap compared to the minimum acceptable requirements (marked in red).

In a "stress scenario" with a 5% interest rate, the couple would need to pay CHF 7,361 monthly—CHF 6,111 of which would go solely toward monthly repayments. The screenshot below shows the details (with the slider set to "Stress"):

Even though an 80% loan-to-value is just acceptable, the affordability rate at 58% far exceeds the 33% maximum (see next screenshot), making the financing clearly unviable.

How much equity is required?

To meet affordability requirements with the same income, the couple would need to contribute CHF 500,000 more in equity, bringing the total to CHF 800,000 instead of CHF 300,000.

Alternative: Higher income

Alternatively, the affordability issue could be resolved through a higher income. However, this would require an annual salary of CHF 265,000—an increase of over CHF 100,000 (+75%)!

Summary

Summary of the three options:

| Option | Equity | Mortgage | Income (gross/year) | Affordability | Loan-to-Value | Link |

|---|---|---|---|---|---|---|

| Initial Situation | CHF 300,000 | CHF 1,200,000 | CHF 150,000 | 58% | 80% | Link |

| More Equity | CHF 800,000 | CHF 700,000 | CHF 150,000 | 33% | 46.7% | Link |

| Higher Income | CHF 300,000 | CHF 1,200,000 | CHF 265,000 | 33% | 80% | Link |

Long-Term Effects

Regardless of whether the problem is solved through more equity or higher income, a substantial debt remains after 15 years. In some cases, the outstanding amount may even be exactly the same as at the beginning.

The Swiss system is designed so that full mortgage repayment is often not the optimal strategy—even if the financial means are available.

Part 1 of the tutorial focused primarily on affordability. In Part 2 (coming soon), we will explore how to use the 7cows.io/ch mortgage calculator to structure a mortgage in a way that better aligns with personal financial goals.